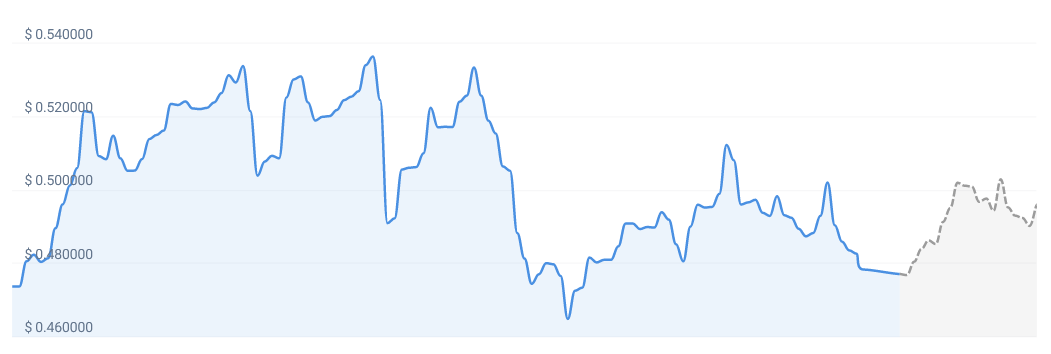

In the fluctuating and often unpredictable world of cryptocurrencies, XRP stands out as an intriguing digital asset. Based on our current forecast, it is projected that the value of XRP will rise by approximately 3.35%, potentially reaching the price point of $0.496168 by July 2, 2023. This prediction, underpinned by a combination of quantitative analysis and market trends, provides an interesting perspective on the future of this cryptocurrency.

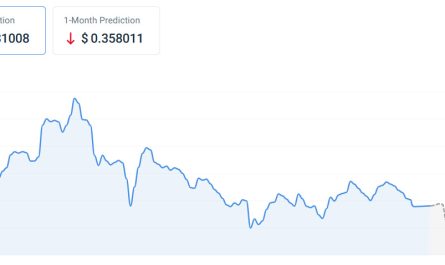

The sentiment surrounding a cryptocurrency is a critical driver of its price movement. At present, the overall sentiment towards XRP is bearish, according to our technical indicators. This sentiment is derived from a complex interplay of factors, including trading volumes, price trends, market momentum, and a myriad of other factors.

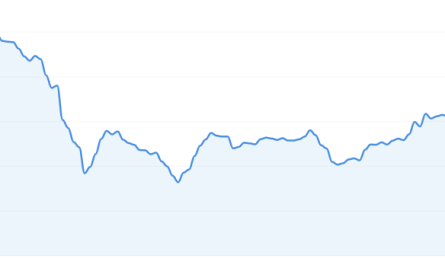

In contrast, the Fear & Greed Index, a widely used tool for gauging the emotions driving the cryptocurrency market, currently stands at 59, indicating a state of ‘Greed’. This suggests that investors, despite the bearish sentiment, are still quite bullish about XRP’s potential. The Fear & Greed Index merges various sources of market data – including volatility, market momentum, social media sentiment, surveys, and dominance – into one digestible score, ranging from 0 to 100. A score above 50 suggests a bullish sentiment, which is somewhat at odds with our bearish sentiment indicator for XRP.

Examining the recent performance of XRP, it’s noteworthy that the digital asset has experienced 57% green days over the last month, with the price closing higher than its opening on 17 out of the past 30 days. This is a positive indication of the currency’s resilience, despite the currently bearish sentiment and the inherent volatility of the cryptocurrency market.

In fact, the last 30 days have seen XRP’s price demonstrate a volatility of 3.41%. While this relatively high volatility might deter some risk-averse investors, it also opens up the door for potential opportunities for those willing to take on more risk. Experienced traders can take advantage of this volatility for potential short-term profits, while long-term believers in XRP may see these price swings as chances to accumulate more coins at lower prices.

Based on our current XRP forecast, we conclude that now may not be the best time to invest in XRP. This conclusion is primarily driven by the bearish sentiment currently surrounding the asset. As always, however, this advice should not replace personalized financial guidance. Every investment, including cryptocurrencies like XRP, carries its unique set of risks, and it’s crucial for individual investors to carry out their due diligence before venturing into the market.

In conclusion, XRP presents a fascinating case study in the world of cryptocurrencies. Despite the current bearish sentiment, the projected price increase and the bullish Fear & Greed Index score suggest a complex market environment. The upcoming period may be less favorable for buying XRP, but the landscape could change swiftly as new developments emerge.

As we continue to track the movements of XRP and other digital currencies, we remain committed to providing our readers with data-driven, insightful analysis. The world of cryptocurrency is an exciting yet complex realm, and our mission is to help both novice and experienced investors navigate it with greater confidence and understanding.